In the world of advanced forex trading Trading FX Broker, forex trading has evolved dramatically over the past few decades. No longer is it solely the domain of banks and large financial institutions; now individual traders and investors can seize opportunities on a global scale. Advanced forex trading involves a sophisticated understanding of the market, combined with strategic planning, risk management, and continuous learning. In this article, we will delve into advanced techniques and strategies that can help you navigate the complex world of forex trading.

Understanding Forex Market Dynamics

The forex market, known for its high liquidity and volatility, operates 24 hours a day, five days a week. Prices fluctuate based on various factors ranging from economic data releases to geopolitical events and market sentiment. Understanding these dynamics is crucial for advanced traders.

Fundamental Analysis

Fundamental analysis is the study of economic indicators that affect currency values. Key indicators include:

- Interest Rates: Central banks control interest rates, which significantly impact currency values. An increase in interest rates typically attracts foreign capital, leading to currency appreciation.

- Gross Domestic Product (GDP): GDP growth rates indicate the economic health of a country. A rising GDP usually strengthens the currency.

- Employment Data: Reports such as the Non-Farm Payrolls in the U.S. can create volatility and indicate economic strength.

Technical Analysis

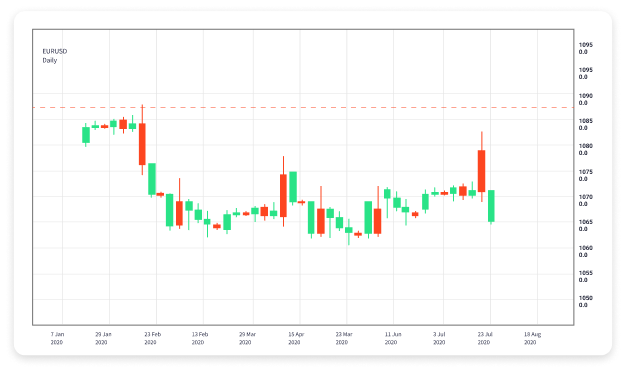

Advanced traders often use technical analysis to identify trends and trading opportunities. Key techniques include:

- Chart Patterns: Patterns such as head and shoulders, flags, and wedges can signal potential market reversals or continuations.

- Indicators: Tools like Moving Averages, RSI, and MACD are used to gauge market momentum and identify trade entry and exit points.

- Support and Resistance Levels: Recognizing these levels can provide insight into potential price reversals or breakouts.

Advanced Trading Strategies

Implementing complex strategies is essential for advanced traders. Here are several techniques:

Scalping

Scalping involves making multiple trades throughout the day to profit from small price changes. This strategy requires quick decision-making and a strong understanding of market conditions.

Position Trading

This long-term strategy involves holding positions for weeks or months, based on thorough research and analysis. It is less affected by short-term volatility and requires a robust risk management plan.

Hedging

Hedging allows traders to protect their positions against adverse price movements. This can be achieved by opening a secondary position in a correlated asset to offset risk.

Algorithmic Trading

Advanced traders often employ algorithms to automate trades based on predetermined criteria. This can eliminate emotional decision-making and increase efficiency.

Risk Management Techniques

Effective risk management is crucial in forex trading. Even advanced traders face the risk of loss; hence, implementing strategies to minimize risk is essential.

Position Sizing

Calculating the correct position size based on your account size and risk tolerance can prevent excessive losses. Many traders advocate risking only a small percentage of their capital per trade.

Setting Stop-Loss Orders

Stop-loss orders limit potential losses by automatically closing positions at predetermined price levels. This is a vital tool for managing risk.

Diversification

Diversifying your trading portfolio across different currency pairs can decrease the risk associated with any single trade by spreading exposure.

Continuous Learning and Adaptation

Advanced forex trading is not static. The market continuously evolves, influenced by economic and political changes. Traders must stay informed and be willing to adapt their strategies accordingly. Here are some ways to continue your education:

- Forex Courses: Consider taking advanced trading courses that cover technical analysis, trading psychology, and algorithmic trading.

- Webinars and Seminars: Attending events provides insights from experienced traders and analysts, enhancing your understanding of market dynamics.

- Reading Trading Books: There are numerous books written by professional traders that can offer valuable strategies and insights.

Conclusion

Advanced forex trading requires a combination of knowledge, skill, and experience. By understanding market dynamics, employing sophisticated strategies, implementing sound risk management practices, and committing to continuous learning, you can enhance your trading prowess. Remember, not every trade will be successful, but with a disciplined approach and a willingness to adapt, you can increase your chances of profitability in the dynamic world of forex trading.